Heat Pump Installation Costs: Germany vs. Europe

Why heat pumps in Germany are significantly more expensive than in neighboring countries

The accompanying graphic visualizes the cost ranges across the six markets examined. The ranges shown should be understood as orientation values and are based on prices identified during research from various sources.

Initial Situation

In Germany, installing a heat pump costs between 20,000 and 40,000 Euros, depending on the source.1 A recent analysis by the Rhineland-Palatinate consumer center, which analyzed 160 real offers from 2024/2025, documented a range of 20,000 to 63,000 Euros, with an average of around 36,000 Euros.2 Other sources cite narrower ranges of 23,000 to 32,000 Euros for typical installations.3

In other European countries, comparable installations are often around half the price. In Great Britain, total costs range between 10,000 and 14,000 Euros, in France between 12,000 and 20,000 Euros, and in the Netherlands between 11,000 and 19,000 Euros.4 Even Austria, with similar technical standards and building regulations, remains 20 to 35 percent below the German level.

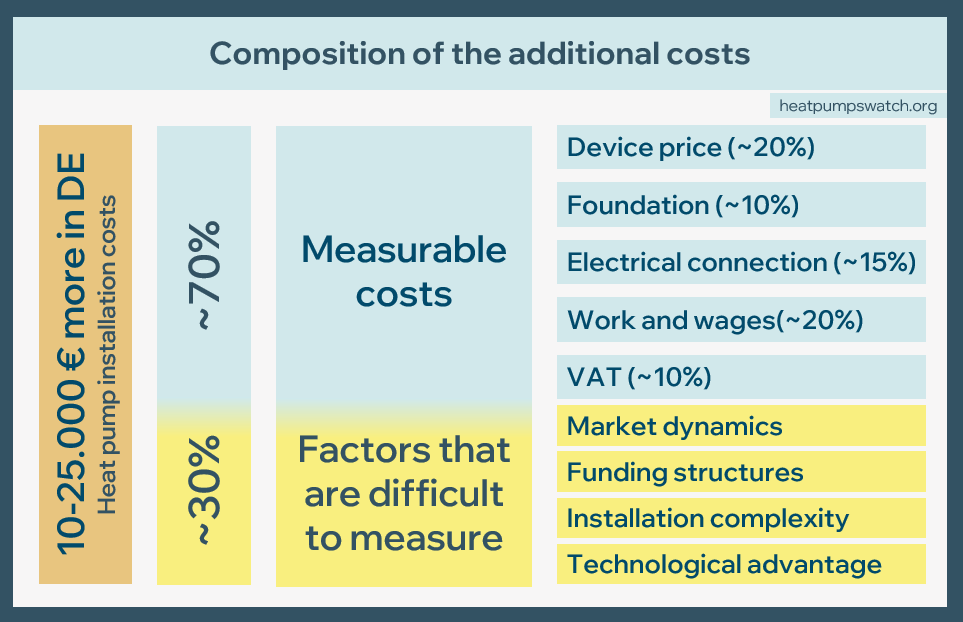

This article uses actual market data from six European countries to document exactly where the price differences lie and what factors are responsible for them. The difference of 10,000 to over 25,000 Euros can be broken down into quantifiable cost drivers and factors that are more difficult to quantify.

Methodology and Data Basis

The aim of this article is to systematically explain the causes for the higher price level of heat pump installations in Germany compared to other European markets. It examines the extent to which the various cost drivers can be quantified.

The analysis distinguishes between quantifiable cost drivers, for which specific price differences in Euro amounts can be named, and non-quantifiable factors that influence the price level but are difficult to quantify. To classify the magnitude of the differences, the price ranges in six European countries are first recorded and compared.

Geographical and Temporal Scope

The comparison covers six European markets: Germany, the United Kingdom, France, the Netherlands, Austria, and Poland. The study period spans from 2022 to 2025. All pricing data refers to air-to-water heat pumps with a heating capacity of 8–10 kW, intended for existing single-family homes. The cost ranges are defined as gross end-customer prices, including all installation and ancillary costs. Sources include consumer protection organizations, market analyses, scientific studies, and European industry associations.5

Comparability and Limitations

Heat pump installations are project-specific and vary depending on building condition, technical requirements, and local circumstances. The documented cost ranges represent average values for air-to-water heat pumps in existing buildings—the by far largest market segment in all countries studied. Actual costs may deviate upwards or downwards in individual cases. The ranges reflect this uncertainty. Heat pumps using other heat sources, such as ground-source heat pumps, were not explicitly considered in the analysis.

European Price Comparison

A look at six European markets reveals a clear gradient. The data availability varies: for France and the Netherlands, industry statistics and funding reports are available; for Austria, comparative analyses from the national energy association; for Poland, market research from specialized professional portals.

Table 1: Cost overview – six European markets

| Country | Price range (pre-tax) | Notes |

| Poland | 9.000–15.000 € | Low labor cost, less bureaucracy |

| United Kingdom | 10.000–14.000 € | 0 % value added tax., simpler standards |

| Netherlands | 11.000–19.000 € | Large variety, standardized systems |

| France | 12.000–20.000 € | Fixed-funding, medium price level |

| Austria | 13.500–20.000 € | Similiar standards as in Germany, but cheaper* |

| Germany | 23.000–40.000+ € | Highest price level in the compared group |

Germany is therefore positioned clearly at the upper end of the European price spectrum. Even Austria, whose building regulations and technical standards are most similar to Germany’s, is 20 to 35 percent below German levels. Poland reaches roughly one-third of German costs. France and the Netherlands are in the European mid-range.

What explains this difference? The gap to most European neighboring countries is roughly double to two-and-a-half times higher—in absolute terms, €10,000 to over €25,000. A price premium of this magnitude cannot be explained by a single factor. The following chapters systematically explore the causes: first, the measurable cost drivers are examined, then the more elusive influences, and finally a concrete case study that makes the findings verifiable.

Category 1: Quantifiable Differences

This category includes cost components that can be substantiated and compared with concrete numbers: equipment prices, foundations, electrical connections, labor hours, labor costs, and value-added tax. Together, these factors explain the majority of the price differences between Germany and the comparison countries.

Equipment Prices and Market Structure

In Germany, premium manufacturers such as Viessmann, Vaillant, Bosch, Stiebel Eltron, and others dominate the market, offering products in the higher price segment ranging from €9,000 to €18,000.6 Asian suppliers like Panasonic, LG, Daikin, Midea, and others serve a lower-price segment starting at around €3,000 to €8,500, but so far play a much smaller role in the German market than in the comparison countries. However, there are exceptions in both groups: German manufacturers also offer lower-cost models, and Asian manufacturers also offer more expensive ones. This discussion reflects the general trend in market positioning.

In the United Kingdom, average equipment prices according to the Microgeneration Certification Scheme (MCS) are around £5,000 to £8,000 (€6,000 to €9,500). In France, the Netherlands, and Poland, simpler models and Asian brands are more commonly installed. The average price level of the equipment alone in these markets is estimated to be 15 to 35 percent below the German average.7 However, the difference is not solely due to list prices: German models typically include more powerful integrated heating elements (6–9 kW instead of optional 3 kW), more complex indoor units with buffer storage, and more sophisticated control technology. They are also often designed for lower operating temperatures and stricter noise requirements.

Simpler variants of the same European manufacturers, available in neighboring countries, are sometimes not offered at all on the German market. This reflects both higher customer expectations and manufacturers’ pricing strategies. Part of the price difference therefore genuinely corresponds to higher performance, while another part is market-driven.

Foundations and Installations

The installation of heat pump outdoor units requires different levels of preparation depending on the country. In Germany, it is common practice—partly due to VDI Guideline 46458—to construct a solid foundation. The Verbraucherzentrale Rheinland-Pfalz documents foundation costs between €1,500 and €2,700, while a study by RWTH Aachen specifies €976.9 In the United Kingdom and the Netherlands, wall-mounted units or simple substructures are more common,10 with costs up to €500. In France and Poland, practices vary regionally but generally remain below German levels. This difference accounts for €1,000 to €2,200 of the total price gap.

Electrical Connection and Grid Integration

In Germany, installations often require extensive modifications to the electrical panel, additional circuit protection, and control technology. The Verbraucherzentrale Rheinland-Pfalz documented costs ranging from €1,800 to €4,000 for the electrical connection.11 A key reason lies in the connection requirements: heat pumps with high-power heating elements (6–9 kW) require a 400 V three-phase connection, whereas in the comparison countries, 230 V with optional 3 kW heating elements is often sufficient.

Since January 2024, there is an additional obligation under § 14a of the German Energy Act (EnWG) to integrate controllable consumption devices into the power grid.12 Heat pumps over 4.2 kW must be equipped with communication interfaces that allow the grid operator to reduce power in case of impending overload. This requires additional metering equipment (smart meters), control boxes, and corresponding wiring. In the comparison markets, such requirements either do not exist or are implemented in a less complex manner.

Installation Time and Labor Cost

Hourly rates for end customers in Germany are around €60 to €70 (journeyman/master)13, compared with approximately €45 to €60 in the United Kingdom, €35 to €45 in France, and €20 to €30 in Poland. In addition, installations in Germany typically take significantly longer. A panel survey by the ZVSHK documented an average of 110 technician hours for a heat pump—compared with 36 hours for a gas boiler.14 The Fraunhofer ISE WESPE study confirms that 81 percent of labor time is spent on installation and travel, and 19 percent on planning and billing.15

Shorter installation times are documented in the comparison countries. This is attributed to standardized processes and often less complex installations, but also to lower bureaucratic requirements. In Germany, hydraulic alignment, VDI 2035-compliant water treatment, extensive documentation for subsidy applications, and the involvement of specialized electricians are standard—tasks that are omitted or simplified in neighboring countries.

VAT

Germany levies a 19 percent VAT on heat pump installations. On a net price of €30,000, this results in a tax burden of approximately €5,700. Since 2022, the United Kingdom has introduced a zero rate for energy-efficient heating technologies—a direct relief that partly explains the price difference with the UK.16 However, even in countries with comparable or higher VAT rates, total costs remain below German levels. Austria and Poland are significantly cheaper than Germany, although both countries partially apply reduced rates for energy-efficient renovations. VAT amplifies existing price differences but is not their primary cause.

Intermin Conclusion: Quantifiable Factors

The following breakdown uses the example of the United Kingdom. In countries with lower wages and lower VAT, such as Poland, the shares shift: there, the difference in labor costs plays a much larger role, while the VAT difference is smaller. However, the total contribution of quantifiable factors remains roughly 70 percent.

Of the €10,000 to over €25,000 price difference compared with the comparison countries, the approximate breakdown is as follows:

Table 2 – Break-down of quantifiable additional costs (DE vs UK)

| Cost item | Extra Costs DE | Share of difference |

| Price of the device (configuration, market structure) | +2.000–4.000 € | ca. 15–25 % |

| Foundations and installation | +1.000–2.200 € | ca. 7–15 % |

| EL connection (400 V, § 14a EnWG) | +1.500–2.500 € | ca. 10–15 % |

| Labor (length + hourly wages) | +1.000–2.000 € | ca. 7–12 % |

| VAT (19 % vs. 0 % in UK) | +5.000–5.700 € | ca. 35–40 % |

| Quantifiable sum | 10.500–16.400 € | ca. 70 % |

Approximately 70 percent of the observed price difference can thus be explained by concrete, measurable factors. It should be noted that while VAT represents the largest single item, it only reaches this magnitude in comparison with the United Kingdom (0% VAT). Compared with France or the Netherlands, which apply similar tax rates, this item largely disappears—there, the other cost drivers take on greater importance. The remaining roughly 30 percent result from the influence factors described below.

Category 2: Hard-to-Quantify Factors

This category includes factors that cannot be expressed in concrete euro amounts but still noticeably affect price levels in Germany. These include market dynamics, subsidy structures, the building stock, and refrigerant policies.

Market Dynamics and Capacity Situation

The German heat pump market experienced extreme fluctuations between 2022 and 2024—with a record sales year in 2023 followed by a 46 percent drop the next year.17 At the same time, average end-customer prices increased by up to around 40 percent. Industry reports documented a phenomenon referred to as “defensive pricing”: installers with high workloads deliberately set high prices to take on only the most lucrative projects.

The situation has now eased noticeably. According to industry data, the average price in 2025 has dropped for the first time by around €4,000 to approximately €30,000. Increased competition from European and Asian manufacturers, better availability of installers, and falling material costs have contributed to this development.18 Standardized installation concepts from larger providers with fixed prices19 are gaining visibility, even though the market remains largely fragmented and craft-oriented. Whether this price decline will stabilize will depend largely on future demand developments and the political framework.

Subsidy Structures and Price Incentives

Germany provides proportional subsidies for heat pumps: depending on household circumstances, 30 to 70 percent of investment costs are eligible for funding (up to €21,000 with a €30,000 cap).20 The higher the offer price, the higher the absolute subsidy. This can create incentives to set prices in a way that maximizes the subsidy.

The United Kingdom follows a different approach: the Boiler Upgrade Scheme provides a fixed amount of £7,500 (approximately €8,900).21 Regardless of the offer price, the subsidy remains constant, encouraging cost-effective solutions. France also works with income-dependent fixed amounts.22

Building Stock and Installation Complexity

Germany has one of the oldest building stocks in Europe. About 50 percent of residential buildings date from before 1979. The generally larger living spaces mean that systems with 2 to 4 kW more heating capacity are typically installed in Germany than, for example, in the UK or the Netherlands—resulting in higher equipment and installation costs.

However, the European comparison shows that France and the UK also have substantial older buildings. Austria has a similarly high proportion of older buildings as Germany—yet with 20 to 35 percent lower installation costs. Building stock therefore explains project-specific additional costs in individual cases, but not the systematically higher price level across all installations.

Refrigerants and Technological Lead

The EU F-Gas Regulation regulates climate-damaging refrigerants through a gradual reduction of allowed quantities. From 2027, only refrigerants with a global warming potential below 150 may be used in new installations.23 Propane (R290) has established itself as an alternative—a natural refrigerant with almost negligible global warming potential but higher safety requirements due to flammability.

Major German manufacturers such as Viessmann, Bosch, and Vaillant switched to R290 relatively early and already offer extensive product ranges with propane refrigerant. Asian manufacturers, more present in other European markets, still partly use R32 or other synthetic refrigerants. R290 units are approximately 10 to 15 percent more expensive to manufacture than comparable R32 models due to additional safety components.24 Installation also incurs additional costs due to safety zones and specific placement requirements. While this technological lead is a long-term advantage, in the short term it contributes to higher prices. As all manufacturers gradually switch to R290, these differences are expected to even out in the coming years.

Interim Conclusion: Hard-to-Quantify Factors

The factors described in this chapter cannot be individually quantified monetarily but act together as a system and amplify the previously described quantifiable cost differences. Years of capacity constraints in the market enabled a price level above pure costs. Proportional subsidy structures provide no incentive to reduce costs. The older building stock tends to require larger systems. And the early switch to R290 increases equipment and installation costs compared with markets where cheaper refrigerants still dominate. In total, these factors are estimated to account for roughly 30 percent of the overall difference compared with the comparison countries.

Case Study: RWTH Aachen / Octopus Energy

The cost drivers identified so far can be verified using a concrete study. RWTH Aachen University, in cooperation with Octopus Energy, conducted a detailed cost comparison for 8-kW air-to-water heat pumps in Germany and the United Kingdom. The study documents average total costs of approximately €28,000 in Germany compared with €14,000 in the UK. A concrete example: €29,719 (Germany) versus €12,095 (UK)—both excluding VAT.

The RWTH study confirms the cost drivers identified in this report on all key points. The authors attribute the price differences to higher-quality equipment, more elaborate foundations and electrical connections, longer installation times with higher labor costs, and the VAT difference. In addition, the study explicitly highlights the influence of proportional subsidy structures.

The comparison calculation illustrates the consequences: after all subsidies, a UK household pays around €3,200 for a heat pump, while a German household with 50 percent funding pays approximately €14,900.25 Even with Germany’s maximum 70 percent subsidy (own contribution around €8,900), the end-customer price remains well above the UK level.

Summary and Context

Key finding: heat pump installations in Germany cost, depending on the source, between €23,000 and over €40,000, placing them €10,000 to €25,000 above the price level of most European neighboring countries. Compared with the UK (€10,000–€14,000), France, the Netherlands, Austria, and Poland, Germany remains by far the most expensive country studied.

The cost difference can be divided into two categories:

Quantifiable Cost Drivers (approx. 70%)

Around 70 percent of the price difference can be explained by measurable factors: higher-quality equipment and market structure (+€2,000–€4,000), more elaborate foundations (+€1,000–€2,200), more expensive electrical connections including §14a requirements (+€1,500–€2,500), longer installation times with higher labor costs (range depending on the comparison country: +€500–€3,000), and higher VAT (+€5,000–€5,700 compared with the UK). In total, these factors account for €10,500–€16,400 of the difference.

Hard-to-Quantify Amplifying Factors (approx. 30%)

The remaining roughly one-third results from factors that cannot be precisely expressed in monetary terms. Market dynamics with years of capacity constraints allowed inflated prices—even though the market has now noticeably eased. Proportional subsidy structures provide no incentive to reduce costs. Germany’s building stock tends to require larger systems, and the early switch by German manufacturers to the propane refrigerant R290 increases equipment and installation costs compared with markets where cheaper refrigerants still dominate.

Interaction of Multiple Causes

The price difference results from the interplay of multiple factors. No single aspect explains the entire difference. The high German prices are the result of a specific combination of technical standards, market structures, subsidy systems, and regulatory requirements.

Price Pressure Despite Subsidies

Although German households receive substantial relief through proportional subsidies of 30 to 70 percent, they still pay more in absolute terms than households in the comparison countries. With 50 percent funding, the remaining personal contribution is roughly €14,000–€16,000—while in the UK, after the fixed-amount subsidy, it is around €3,200. This places a burden on both private households and public budgets and makes scaling across all income levels more difficult.

Outlook

Early signs point to a market easing: prices in 2025 have slightly decreased for the first time, and competition is increasing due to new market entrants. Technical standardization can reduce installation times. Opening the market to simpler equipment variants could create further price pressure. Adjusting the subsidy structure toward fixed grant amounts could incentivize more cost-efficient solutions. Reducing bureaucracy could decrease planning and documentation effort. Which measures are politically feasible and economically sensible requires further discussion involving all stakeholders.

All Episodes

Episode 1: Beyond the Noise: What the Heat Pump Truly Means for Our Society

Episode 2: 20 Years of Field Studies Prove: Heat Pumps Efficient in Existing Buildings

Episode 3: From Niche to Norm: 20 Years of Progress in Heat Pump Technology

Episode 4: The Heat Pumps Fact Check: Ten Myths Scientifically Disproven

Episode 5: Efficiency Knows no Age: Heat Pumps in Buildings from 1826 to Present Day

Episode 6: Heat Pumps in Multi-Family Buildings: The Key to Urban Decarbonization

Episode 7: Hybrid Heat Pump Systems

Episode 8: Operating Costs: Heat Pumps Already Outperform Gas Heating Systems Today

Episode 9: Thousands of Heat Pumps Models on the Market: How to Find the Right One for Me?

Episode 10: Heat Pumps and AI: A Perfect Match?

Episode 11: Between Air Conditioner and Heating System

Episode 12: Heating Technologies Compared

Episode 13: Heat Pump Installation Costs: Germany vs. Europe

- Verbraucherzentrale Rheinland-Pfalz (2025): Wärmepumpen-Marktanalyse. Mainz., EnBW Energie Baden-Württemberg AG (2025): Wärmepumpe: Preisentwicklung & Trends bis 2030. Karlsruhe., Bundesverband Wärmepumpe (BWP) e.V. (2024/2025): Branchenstatistiken. Berlin., heizungsfinder.de (2024): Marktübersichten Wärmepumpen-Kosten. Online accessible., co2online gGmbH (2024): Wärmepumpen-Ratgeber. Berlin., Wärmepumpe Austria (2024): Marktstatistik Wärmepumpen Österreich. Wien., European Heat Pump Association (EHPA) (2022–2024): Market Reports. Brussels. ↩︎

- Verbraucherzentrale Rheinland-Pfalz (2025): Auswertung von 160 Angeboten für Luft-Wasser-Wärmepumpen (Erhebungszeitraum Oktober 2024 bis Mai 2025). Price Range: 20.000–63.000 Euro, Durchschnitt 36.300 Euro, Median 35.000 Euro. Only 26 % of the offers complete. Mainz. ↩︎

- EnBW Energie Baden-Württemberg AG (2025): Market analysis heat pump pricing development. Average price ca. 30.000 Euro (Lowered by ca. 4.000 Euro compared to 2024). Karlsruhe., Verbraucherzentrale Nordrhein-Westfalen (2024): Heat pump costs in a single-family home. Price range 25.000–35.000 Euro. Düsseldorf. ↩︎

- Heizsparer.de (2023–2025): Marktübersichten Wärmepumpen-Kosten Europa. Online accessible., co2online gGmbH (2023–2025): Wärmepumpen-Kostenvergleich europäische Märkte. Berlin., ADEME – Agence de la transition écologique (2023–2025): Données sur les pompes à chaleur en France. Paris., Energy Saving Trust (2023–2025): Heat Pump Costs and Performance Data. United Kingdom., Wärmepumpe Austria (2023–2025): Marktdaten Österreich. Wien., Polnische Fachportale (cieplosystemowe.pl, instalacjebudowlane.pl) (2023–2025): Market data heat pumps Poland. ↩︎

- ADEME – Agence de la transition écologique (2024): Données marché pompes à chaleur France. Paris.; Warmtepomp Instituut Nederland (2024): Marktgegevens warmtepompen. Nederland.; Wärmepumpe Austria (2024): Österreichische Marktstatistik. Wien.; cieplosystemowe.pl, instalacjebudowlane.pl (2024): Polnische Fachportale für Heizungstechnik.; European Heat Pump Association (EHPA) (2022–2024): European Heat Pump Market and Statistics Reports. Brussels.; Verbraucherzentrale Rheinland-Pfalz (2025): Wärmepumpen-Preisvergleich Deutschland. Mainz.; Energy Saving Trust (2025): Heat Pump Pricing UK. United Kingdom.; ADEME (2025): Coûts des pompes à chaleur en France. Paris.; Wärmepumpe Austria (2025): Kostenanalyse Österreich. Wien.; Polnische Fachportale (2025): market data heat pumps Poland.; Bundesverband Wärmepumpe (BWP) e.V. (2025): Industry study Germany. Berlin. ↩︎

- 42watt.de (2025): Gerätepreisvergleiche Wärmepumpen. Online verfügbar.; Vattenfall GmbH (2025): Wärmepumpen-Produktvergleich. Berlin.; gruenes.haus (2025): Heat pump market overview. Premium manufacturers (Viessmann, Vaillant, Bosch, Wolf): 9.000–18.000 Euro. Asian providers (Panasonic, LG, Midea): 2.800–8.500 Euro. Online accessible.; Microgeneration Certification Scheme (MCS) (2025): UK Heat Pump Installation Data. UK-average: ca. 5.000–8.000 GBP (6.000–9.500 Euro). United Kingdom. ↩︎

- ADEME (2024): Prix moyens des équipements de pompes à chaleur en France. Durchschnittliche Gerätepreise 5.000–8.000 Euro. Paris.; Warmtepomp Instituut Nederland (2024): Gemiddelde apparaatprijzen warmtepompen. Average equipment prices 5.000–8.000 Euro. Netherlands.; Polish trade portals (2024): Ceny pomp ciepła na rynku polskim. Average equipment prices 5.000–8.000 Euro, comapred to 9.000–12.000 Euro in Germany. ↩︎

- VDI – Verein Deutscher Ingenieure (2018): VDI 4645 – Planung und Dimensionierung von Heizungsanlagen mit Wärmepumpen in Ein- und Mehrfamilienhäusern. Technische Anforderungen an Aufstellung und Fundamentierung. Düsseldorf: VDI-Verlag. ↩︎

- Verbraucherzentrale Rheinland-Pfalz (2025): Angebotsauswertung Wärmepumpen-Installationen. 50 % of the offers without foundation costs, 33 % without electrical installation. Mainz.; Vering, H., Kühn, L., Maier, L., Müller, D. (2025): Analyse der Endkundenpreise für Luft-Wasser-Wärmepumpen: Germany – United Kingdom. White Paper RWTH-EBC 2025-001. Foundation costs precisely 976 Euro. RWTH Aachen University. DOI: 10.18154/RWTH-2025-05335. ↩︎

- UK Heat Pump Association (2023): Installation Standards and Best Practices. Wallmounting and simple sub-construction are widespread in Great Britain. United Kingdom. ↩︎

- Verbraucherzentrale Rheinland-Pfalz (2025): Angebotsauswertung Elektroanschlusskosten. 33 % of the offer without electrical installation. Costs 1.800–4.000 Euro. Mainz. ↩︎

- Bundesnetzagentur (2024): Festlegung zur Integration steuerbarer Verbrauchseinrichtungen gemäß § 14a Energiewirtschaftsgesetz (EnWG). In effect since 1st January 2024 for new devices. Bonn. ↩︎

- Zentralverband Sanitär Heizung Klima (ZVSHK) (2024): Verrechnungssätze im SHK-Handwerk 2024. Geselle ca. 61 EUR/h, Meister ca. 70 EUR/h (ohne MwSt.). Berlin.; Heizsparer.de (2024): Europäischer Vergleich Installateur-Stundensätze. UK ca. 45–60 EUR/h. Online accessible.; co2online gGmbH (2024): hourly wages Europe. FR ca. 35–45 EUR/h, PL ca. 20–30 EUR/h. Berlin. ↩︎

- Zentralverband Sanitär Heizung Klima (ZVSHK) (2024): Panelbefragung Installationszeiten (n = 1.121 interviewees, Juli 2024). Average installation duration heat pump 110 hours compared to gas boiler 36 hours. Berlin. ↩︎

- Fraunhofer-Institut für Solare Energiesysteme ISE (2025): WESPE-Studie – Wärmepumpen-Installation Zeitaufwand und Prozessoptimierung. Analyse von 30 Wärmepumpen-Installationen. Time allocation: 81 % Installation and commute (107 hours), 19 % planning, consultation and billing (26 hours). Freiburg. ↩︎

- Eurostat (2024): VAT Rates Applied in the Member States of the European Union. VAT rates in EU member states. UK: 0 % since April 2022. In Austria and Poland, lower rates can be applied to energetic renovations. Luxembourg. ↩︎

- Bundesverband der Deutschen Heizungsindustrie (BDH) (2020–2024): Absatzstatistiken Wärmepumpen Deutschland. Köln.; Bundesverband Wärmepumpe (BWP) e.V. (2025): Branchenstudie Wärmepumpenmarkt Deutschland. Berlin.; EnBW Energie Baden-Württemberg AG (2025): Price development heat pumps. First time decline to ca. 30.000 Euro average. Karlsruhe. ↩︎

- gruenes.haus (2025): Preisentwicklung von Wärmepumpen (bis Dezember 2025). Since 2023 price declines visible. 2025: Average ca. 30.000 Euro (−4.000 Euro comapred to 2024). More competition with European and Asian manufacturers, better accessibility of installers. Online accessible.; EnBW Energie Baden-Württemberg AG (2025): Wärmepumpe: Preisentwicklung & Trends bis 2030. Karlsruhe. ↩︎

- Thermondo GmbH (2023–2024): Standardisierte Installationskonzepte und Festpreismodelle Wärmepumpen. Berlin.; Enpal B.V. (2023–2024): Wärmepumpen-Festpreisangebote Deutschland. Berlin.; 1KOMMA5° GmbH (2023–2024): Systemlösungen Wärmepumpen mit Festpreisgarantie. Hamburg. ↩︎

- Bundesamt für Wirtschaft und Ausfuhrkontrolle (BAFA) (2024): Förderrichtlinien Bundesförderung für effiziente Gebäude (BEG) – Einzelmaßnahmen. Grant rates 30–70 % of the suitable costs, capped at 30.000 Euro (max. 21.000 Euro benefit). Eschborn. ↩︎

- UK Department for Energy Security and Net Zero (2024): Boiler Upgrade Scheme (BUS) – Grant Scheme for Low Carbon Heating. Festbetrag 7.500 GBP (ca. 8.900 Euro) for heat pump installlation. London. ↩︎

- ADEME – Agence de la transition écologique (2024): MaPrimeRénov’ – Aide financière pour la rénovation énergétique. Income-dependent fixed amounts 4.000–9.000 Euro for heat pumps. Paris. ↩︎

- Europäische Chemikalienagentur (ECHA) (2024): Verordnung (EU) 2024/573 über fluorierte Treibhausgase (F-Gase-Verordnung). From 2027 on: only refrigerants with Global Warming Potential (GWP) < 150 in new devices allowed. Helsinki. ↩︎

- autarc.energy (2025): Vergleich R290- und R32-Wärmepumpen. R290-heat pumps ca. 10–15 % more expensive than R32-devices due to additional security compenents. Online accessible; memodo.de (2025): Kältemittel-Vergleich Wärmepumpen. Online verfügbar.; new-heating.com (2025): R290 Propan Wärmepumpen. Online verfügbar.; Bosch Thermotechnik GmbH (2025): Cited in various trade media: „Price-wise no significant difference” between R290 and R32. Installation cost via security zones and special requirements nonetheless higher. ↩︎

- Vering, H., Kühn, L., Maier, L., Müller, D. (2025): Analyse der Endkundenpreise für Luft-Wasser-Wärmepumpen: Deutschland – Vereinigtes Königreich. White Paper RWTH-EBC 2025-001. Kostenvergleich unter Berücksichtigung der Fördersysteme. UK Boiler Upgrade Scheme: Festbetrag 7.500 GBP. DE BEG: 30–70 % of the costs. RWTH Aachen University, in cooperation with Octopus Energy. DOI: 10.18154/RWTH-2025-05335. ↩︎